Equip Your Organization: Bagley Risk Management Insights

Equip Your Organization: Bagley Risk Management Insights

Blog Article

Exactly How Animals Danger Defense (LRP) Insurance Coverage Can Secure Your Livestock Financial Investment

Livestock Risk Defense (LRP) insurance coverage stands as a trusted guard against the unforeseeable nature of the market, using a critical approach to guarding your possessions. By diving right into the details of LRP insurance policy and its complex benefits, livestock producers can fortify their investments with a layer of security that transcends market fluctuations.

Understanding Livestock Risk Protection (LRP) Insurance

Recognizing Livestock Risk Protection (LRP) Insurance is crucial for animals producers aiming to alleviate monetary dangers related to rate changes. LRP is a government subsidized insurance coverage item designed to shield producers versus a decrease in market prices. By offering protection for market value declines, LRP aids producers secure in a floor cost for their livestock, making sure a minimum degree of revenue no matter of market fluctuations.

One trick aspect of LRP is its adaptability, allowing manufacturers to customize insurance coverage levels and plan lengths to fit their details needs. Manufacturers can choose the variety of head, weight array, protection rate, and coverage period that align with their production objectives and risk resistance. Recognizing these customizable options is essential for producers to successfully handle their price danger exposure.

Additionally, LRP is available for numerous livestock kinds, consisting of cattle, swine, and lamb, making it a versatile threat administration device for livestock producers across various markets. Bagley Risk Management. By acquainting themselves with the complexities of LRP, producers can make educated choices to guard their financial investments and ensure economic stability when faced with market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

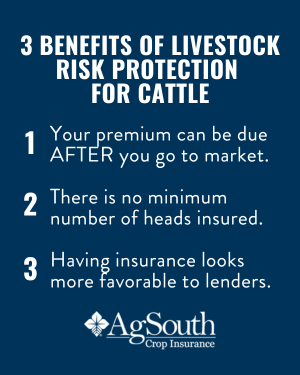

Livestock producers leveraging Livestock Risk Protection (LRP) Insurance coverage obtain a strategic benefit in securing their financial investments from rate volatility and safeguarding a steady monetary footing in the middle of market uncertainties. One essential benefit of LRP Insurance policy is rate defense. By establishing a flooring on the cost of their livestock, producers can alleviate the threat of substantial monetary losses in the occasion of market recessions. This allows them to plan their budgets better and make educated choices regarding their procedures without the continuous worry of price fluctuations.

Additionally, LRP Insurance coverage offers producers with peace of mind. Overall, the advantages of LRP Insurance coverage for animals manufacturers are considerable, using a useful device for handling danger and making sure monetary safety and security in an unforeseeable market atmosphere.

Exactly How LRP Insurance Mitigates Market Risks

Mitigating market threats, Livestock Risk Defense (LRP) Insurance policy offers livestock manufacturers with a trustworthy shield against cost volatility and financial unpredictabilities. By using protection versus unforeseen price decreases, LRP Insurance aids producers safeguard their investments and maintain economic security despite market changes. This kind of insurance coverage permits animals manufacturers to secure a price for their pets at the beginning of the policy duration, making sure a minimum rate level despite market modifications.

Steps to Secure Your Animals Financial Investment With LRP

In the realm of agricultural risk administration, carrying out Livestock Danger Security (LRP) Insurance includes a critical process to safeguard financial investments against market changes and uncertainties. To protect your livestock financial investment successfully with LRP, the first step is to evaluate the particular dangers your procedure faces, such as rate volatility or unforeseen climate occasions. Next off, it is critical to study and pick a trustworthy insurance policy copyright that offers LRP policies customized to your animals and business needs.

Long-Term Financial Protection With LRP Insurance Policy

Making certain enduring economic stability with the use of Livestock Threat Protection (LRP) Insurance policy is a sensible long-term approach for farming manufacturers. By incorporating LRP Insurance into their threat management plans, farmers can protect their livestock investments versus unpredicted market changes and negative events that could threaten their economic wellness over time.

One key benefit of LRP Insurance policy for long-lasting monetary security is the tranquility of mind it uses. With a trusted insurance coverage in area, farmers can reduce the financial threats connected with volatile market conditions and unexpected losses due to variables such as illness outbreaks or all-natural disasters - Bagley Risk Management. This stability allows manufacturers to concentrate on the daily operations of their animals business without consistent fear regarding potential monetary setbacks

In Addition, LRP Insurance supplies a structured strategy to handling threat over the long term. By establishing specific insurance coverage degrees and choosing ideal endorsement periods, farmers can customize their insurance prepares to straighten with their financial objectives and risk tolerance, ensuring a sustainable and safe future for their animals procedures. In final thought, purchasing LRP Insurance policy is a proactive method for farming producers useful content to attain enduring monetary security and safeguard their resources.

Conclusion

Finally, Animals Danger Defense (LRP) Insurance is an he said important tool for livestock manufacturers to reduce market risks and secure their investments. By understanding the benefits of LRP insurance policy and taking actions to apply it, manufacturers can attain lasting economic security for their operations. LRP insurance provides a safeguard against rate changes and makes sure a degree of security in an uncertain market atmosphere. It is a smart option for protecting livestock investments.

Report this page